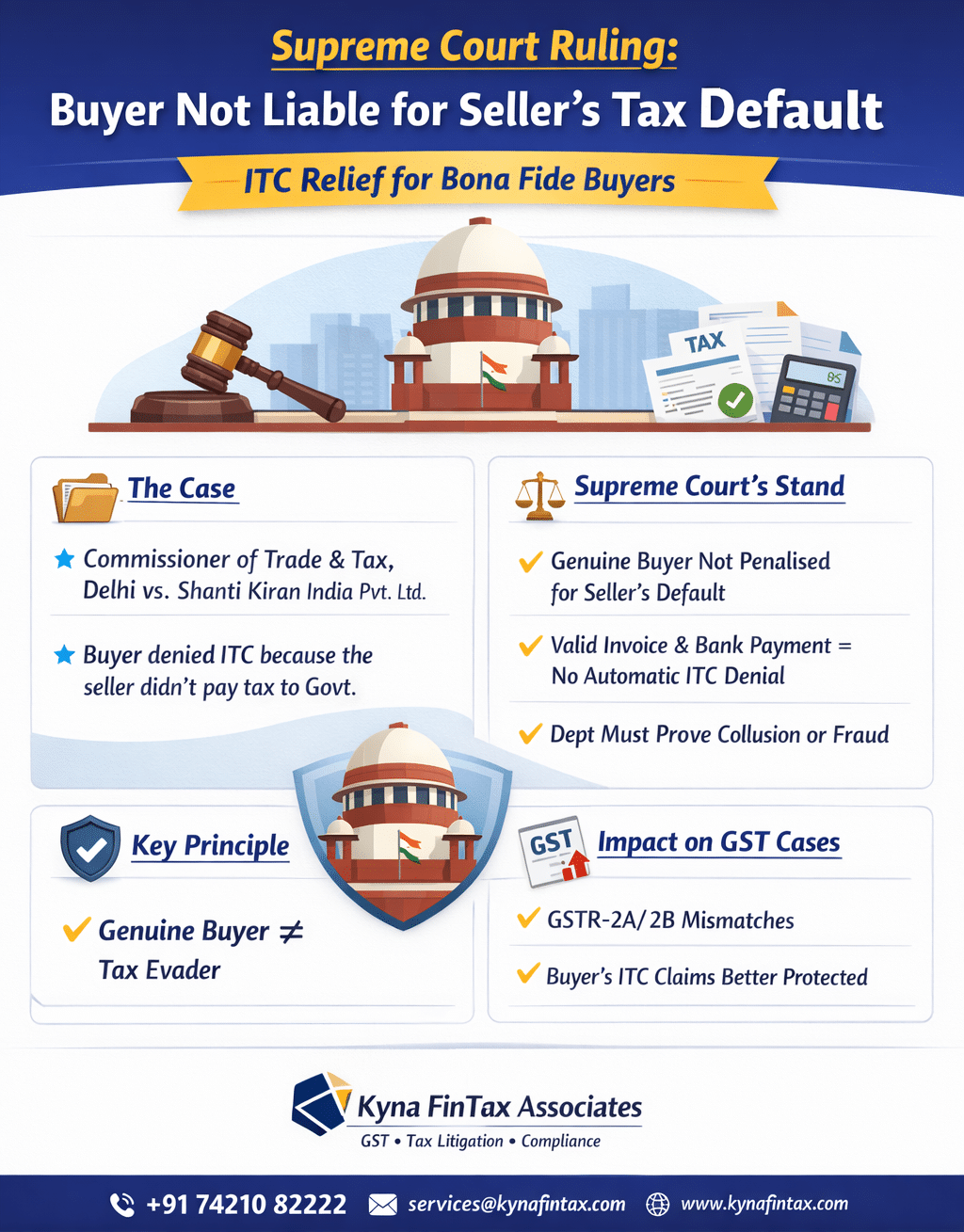

Buyer Not Liable for Seller’s Tax Default: Supreme Court’s Landmark Principle on Input Tax Credit

Introduction

Input Tax Credit (ITC) is the backbone of every value-added indirect tax system. Whether under the earlier Value Added Tax (VAT) laws or the present Goods and Services Tax (GST) regime, ITC ensures that tax is levied only on value addition and not on the entire transaction value.

However, for years, taxpayers have faced a serious and recurring problem — denial of ITC due to the seller’s failure to deposit tax with the Government, despite the buyer having acted honestly and complied with all legal requirements.

This controversy reached the Supreme Court in the landmark case of

Commissioner, Trade & Taxes, Delhi vs. Shanti Kiran India Pvt. Ltd.

The ruling laid down a foundational legal principle:

A bona fide purchasing dealer cannot be punished for the default of the selling dealer, unless collusion or fraud is established.

Although the case arose under the Delhi VAT Act, its reasoning continues to play a crucial role in GST-era ITC litigation, especially in cases involving supplier defaults, non-filing of returns, or GSTR-2A/2B mismatches.

Background of the Case

M/s Shanti Kiran India Pvt. Ltd. was a registered dealer under the Delhi Value Added Tax Act, 2004. The company claimed Input Tax Credit on purchases made from registered selling dealers.

The factual position was clear and undisputed:

- Purchases were genuine

- Sellers were registered dealers

- Valid tax invoices were issued

- Payments, including VAT, were made through banking channels

- Goods were actually received and used in business

Despite this, the Department denied ITC on the sole ground that the selling dealers failed to deposit the tax collected into the Government treasury.

The Assessing Authority relied on Section 9(2)(g) of the DVAT Act, which restricted ITC where tax was not “actually paid” to the Government.

The Core Legal Issue

The central question before the courts was simple but far-reaching:

Can Input Tax Credit be denied to a purchasing dealer merely because the selling dealer failed to deposit tax with the Government, even when the buyer has paid tax, possesses valid invoices, and the transaction is genuine?

Department’s Traditional Stand: Why Buyers Were Penalised

Historically, tax departments across states followed a strict approach:

- VAT and GST are invoice-based systems

- If tax does not reach the Government, revenue leakage occurs

- Denying ITC to buyers was considered an enforcement tool

Authorities argued that:

- ITC is a concession, not an absolute right

- Buyer must ensure the seller’s compliance

- Supplier default breaks the tax chain

This approach led to:

- Mechanical ITC reversals

- Huge interest (18%) and penalties

- Severe cash-flow stress for MSMEs

- Endless litigation

Delhi High Court’s Progressive Interpretation

The Delhi High Court rejected the Department’s rigid stance.

The Court held that:

- A buyer cannot be expected to police the seller

- Once the buyer has:

- Paid tax

- Received goods

- Obtained valid invoices

the buyer’s statutory obligation ends

The High Court ruled that:

The Department’s remedy lies against the defaulting seller, not against an innocent buyer.

Section 9(2)(g) was read in a manner consistent with fairness, proportionality, and natural justice.

Supreme Court’s Analysis

When the matter reached the Supreme Court, the Court adopted a balanced and legally sound approach.

Key Observations

- Protection of Bona Fide Buyers

Tax laws are meant to punish evaders, not honest taxpayers. - No Automatic ITC Denial

Seller default alone cannot justify ITC denial. - Verification Is Permissible

Authorities are entitled to verify:- Genuineness of transactions

- Movement of goods

- Payment trails

- Burden of Proof Lies on the Department

Unless collusion, fraud, or sham transactions are established, ITC cannot be denied.

Supreme Court’s Final Direction

Instead of granting blanket relief, the Supreme Court remanded the matter to the Assessing Authority with clear guidance:

- Verify whether:

- Purchases are genuine

- Payments are through banking channels

- Valid tax invoices exist

- If no evidence of collusion or fake transactions is found:

ITC must be allowed

This approach protects revenue without sacrificing justice.

Legal Principle Established

The ruling firmly establishes:

Seller’s default ≠ Buyer’s offence

A purchasing dealer cannot be treated as a defaulter if:

- Transactions are genuine

- Documentation is proper

- Payments are traceable

- There is no collusion

Relevance Under the GST Regime

Although delivered under DVAT, the principle has strong persuasive value under GST, especially in disputes involving:

- GSTR-2A / 2B mismatches

- Supplier non-filing of returns

- Supplier tax defaults

- Section 16(2)(c) disputes

Courts increasingly hold that:

- ITC cannot be denied mechanically

- Buyer’s conduct matters

- Fraud must be proved, not presumed

Buyer Benefits: Pre vs Post Judgment

| Aspect | Earlier Position | After Shanti Kiran Principle |

|---|---|---|

| ITC denial | Automatic | Fact-based |

| Burden of proof | On buyer | On Department |

| Seller default | Buyer punished | Seller targeted |

| Litigation success | Low | High (if genuine) |

| MSME impact | Severe | Substantially reduced |

Practical Checklist for Buyers

To defend ITC claims effectively:

- Verify supplier GST registration at purchase time

- Pay through banking channels only

- Retain:

- Tax invoices

- E-way bills

- Goods receipt notes

- Bank statements

- Maintain records for at least 72 months

- Respond to SCNs with documentary proof and judicial support

The Supreme Court, through Shanti Kiran India Pvt. Ltd., reaffirmed a core principle of tax justice:

Honest buyers should not suffer for another person’s default.

While the law allows scrutiny, it does not permit harassment.

While revenue must be protected, fairness cannot be sacrificed.

For genuine businesses, this judgment remains a powerful shield against arbitrary ITC denial — under both VAT and GST.

Kyna FinTax Associates

Kyna FinTax Associates is a Delhi-based professional firm specialising in GST litigation, ITC disputes, tax notices, ROC compliances, and indirect tax advisory.

Contact Details

Kyna FinTax Associates

WZ-1390/Z2, 3rd Floor, Nangal Raya Extension

South West Delhi – 110046

📞 +91 74210 82222

📧 services@kynafintax.com

🌐 https://kynafintax.com