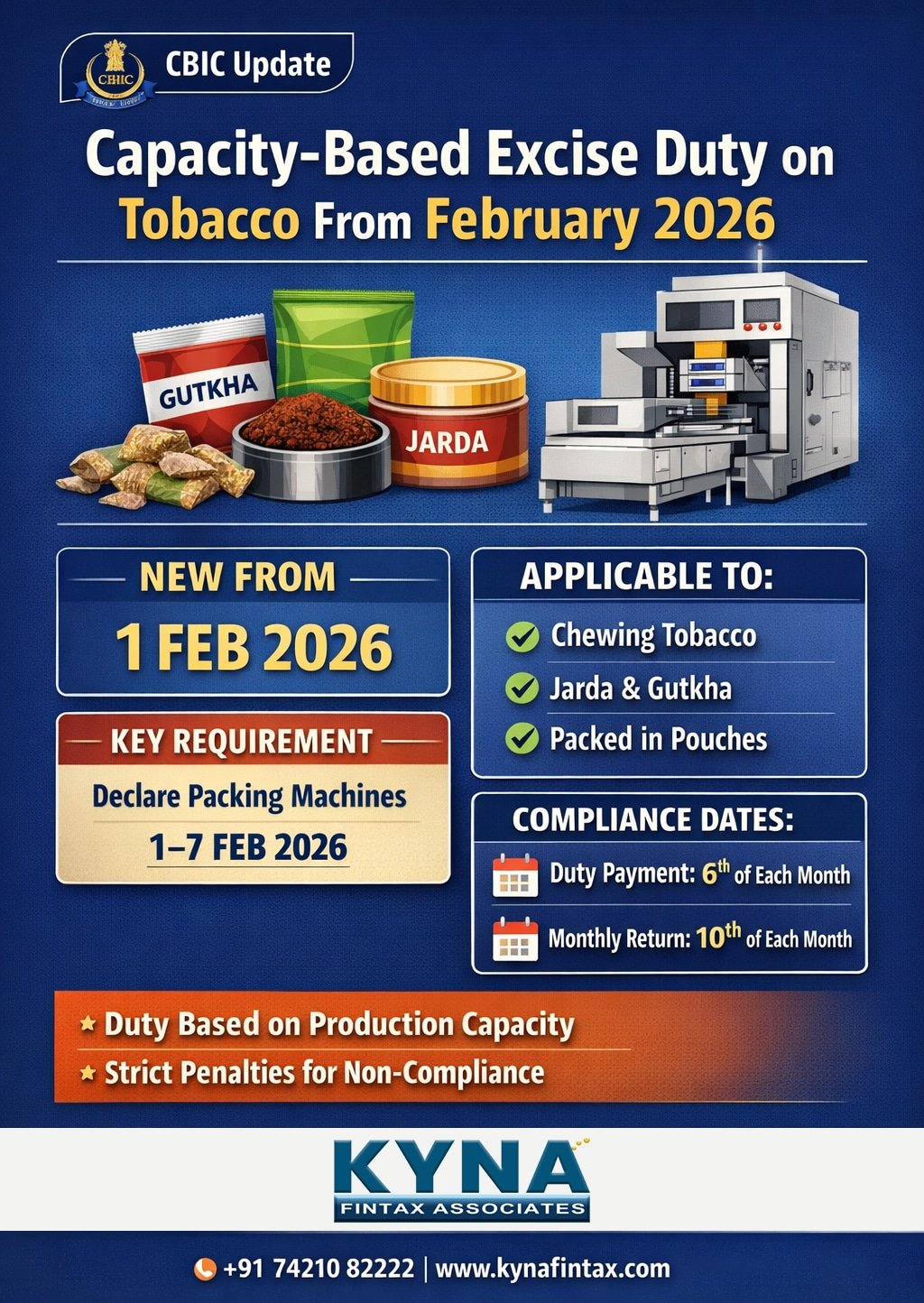

Capacity Based Central Excise Duty on Chewing Tobacco Tax, Jarda & Gutkha from 1 February 2026

The Central Board of Indirect Taxes and Customs (CBIC) has notified a major change in the excise duty framework for manufacturers of chewing tobacco, jarda scented tobacco and gutkha. With effect from 1st February 2026, Central Excise Duty on these products will be levied on a capacity based mechanism instead of traditional valuation methods, subject to specified conditions.

This move is aimed at strengthening compliance, preventing revenue leakage, and bringing greater transparency in sectors using packing machines.

Applicability of Capacity Based Excise Duty

The new mechanism will apply where the following conditions are satisfied:

• The goods are chewing tobacco tax, jarda scented tobacco or gutkha

• The products are manufactured with the aid of packing machines

• The products are packed in pouches

In such cases, Central Excise Duty shall be calculated based on the capacity of production of the packing machines, irrespective of actual production or sales.

The provisions will come into force w.e.f. 1st February 2026.

No Requirement for Fresh Central Excise Registration

CBIC has clarified that taxpayers already registered under Central Excise are not required to obtain a new registration merely because of the shift to the capacity based duty regime.

However, all applicable procedural requirements under the notified rules must be followed strictly.

Mandatory Declaration of Packing Machines

Every manufacturer covered under this scheme is required to file a declaration in the prescribed format containing details of packing machines installed at their premises.

Declaration filing window:

1st February 2026 to 7th February 2026

The declaration must be submitted to the Jurisdictional Deputy Commissioner or Assistant Commissioner of Central Excise.

Failure to file accurate or timely declarations may result in penal consequences.

Monthly Compliance Requirements

Manufacturers falling under the capacity based excise duty regime must comply with the following timelines:

| Compliance | Due Date |

|---|---|

| Central Excise Duty payment for the month | 6th day of the same month |

| Monthly Central Excise Statement | 10th day of the same month |

Timely payment and filing are crucial to avoid interest, penalties, or enforcement action.

Other Cases – Duty Based on Retail Selling Price

In cases where capacity based provisions are not applicable, such as certain tin-packed products, Central Excise Duty shall continue to be calculated on the assessable value derived from the Retail Selling Price (RSP), subject to applicable abatements.

Legal Reference

This change has been notified vide Notification No. 04/2025 – Central Excise dated 31st December 2025, issued by CBIC.

Manufacturers are advised to carefully review the notification and applicable rules to ensure complete compliance.

What Manufacturers Should Do Now

• Review the number, type and capacity of packing machines

• Prepare machine-wise declarations in advance

• Ensure internal compliance systems are aligned with monthly timelines

• Seek professional guidance to avoid classification or procedural errors

Early preparedness will help businesses transition smoothly into the new regime.

Need Professional Assistance?

At Kyna FinTax Associates, we assist manufacturers with:

• Central Excise compliance & advisory

• Capacity based duty calculations

• Machine declarations & documentation

• Ongoing monthly compliance support

Kyna FinTax Associates

📍 WZ-1390/Z2, 3rd Floor, Nangal Raya Extension,

South West Delhi – 110046

📞 +91 74210 82222

📧 services@kynafintax.com

🌐 https://kynafintax.com